Written By

Jon Mailer

CEO & Founder – PROTRADE United

Author of ‘Not Just a Tradie’

Written By

Jon Mailer

CEO & Founder – PROTRADE United

Author of ‘Not Just a Tradie’

Who taught you or how did you learn to price your jobs? Did you get taught be a seasoned master or did you learn on the fly, winging and hoping that you would make some money, or a mixture of both. In our experience more than 80% of business owners are undercharging for the work they are doing . . . meaning reduced income, profit and cash.

Whatever method you use, let’s do a quick check in.

PROTRADE United Managing Director, Jason Loft with PROTRADE United Client, Elite Painting and Decorating Services

PROTRADE United Managing Director, Jason Loft with PROTRADE United Client, Elite Painting and Decorating Services

This article is designed to give you a brief and general overview of how to price your work profitably. I would like to emphasise that is a brief overview and that your individual business and situation will have to be considered. As your work projects become more complex it is vital that you invest time to understand your project costs together with your overhead expenses to ensure that you price profitably every time.

Your business may be different to other businesses, in many ways. Therefore, it is important you work out the numbers for your business vs. comparing yourself to others.

Let’s start by working backwards from your goals.

You are in business to be rewarded for your effort and the value that you bring to the marketplace. Let’s begin with what you want to keep as a pre-tax profit after paying yourself a market salary for your role in the business.

• <10% is almost break-even – given monthly variations and potential project blow outs, weather hold ups and slow paying customers.

• 15% is a great starting point.

• >20% and you are starting to fly.

For every project that you win, complete, and get paid for, there is an associated cost from your Overheads. It is essential that each project that you price recovers this expense otherwise there is no sense running a business! These overheads include marketing, insurance, motor vehicle expenses, equipment, software, administration wages, etc.

To calculate this, divide your Overheads (excluding field labour) by your sales for the last 12 months.

Example:

• 12 months overheads = $300,000

• 12 months sales = $1,000,000

• Overhead recovery rate: $300,000 / $1,000,000 = 30%

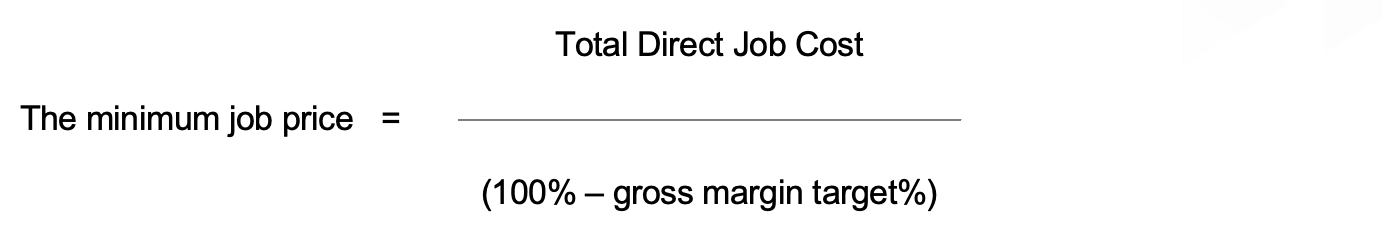

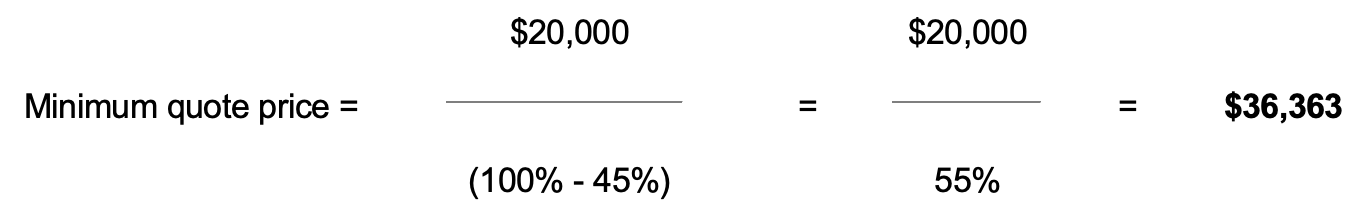

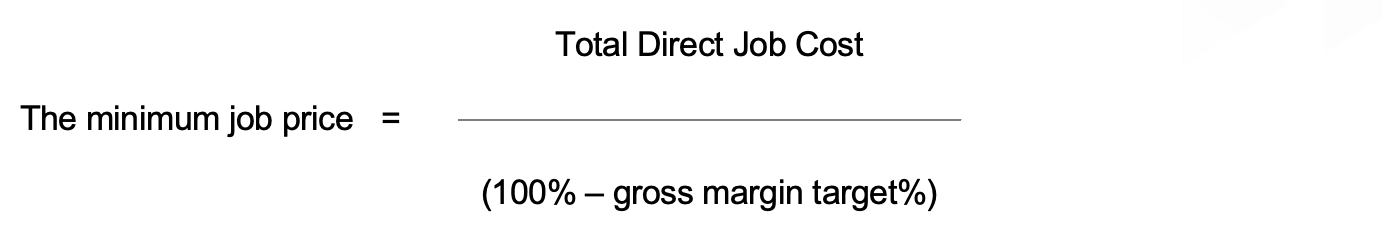

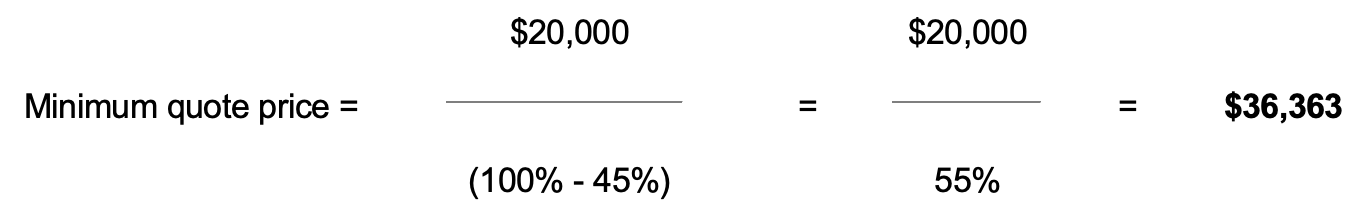

Your Gross Profit margin target = Net Margin target + Overhead Recovery Rate.

In the example above: Gross Profit margin target = 15% + 30% = 45%.

This is now the minimum Gross Margin needed to cover overheads and hit the pre-tax profit target.

Written By

Jon Mailer

CEO & Founder – PROTRADE United

Author of ‘Not Just a Tradie’

Australia and New Zealand’s #1 Business Coaching and Advisory Organisation, dedicated to the Trades and Construction Industry. With over 20 years of practical experience, we have a proven track record of helping more than 3900 business owners gain greater clarity, consistency and choice.

Australia and New Zealand’s #1 Business Coaching and Advisory Organisation, dedicated to the Trades and Construction Industry. With over 20 years of practical experience, we have a proven track record of helping more than 3900 business owners gain greater clarity, consistency and choice.

Work out the total costs for delivering the job. Include:

All materials

• Sub-contractors (what they will invoice you for)

• Specialised equipment hire (if you own your own – still charge the customer what you would have to pay in hire fees if you didn’t own it. EG: Jetter, digger, etc.)

• Waste/rubbish removal

• Job specific council/compliance/insurance fees & charges

• Field labour that you employ directly***(from start to finish of the job)

*** With your field labour that you employ directly, use the Hourly Rate Calculator on the PROTRADE United Website to determine the actual cost per hour for each employee. The calculator will account for salary (plus extras), available days per year (after entitlements), inefficiencies/hold ups such as weather, training, meetings, errors, etc.

For example: Total Direct Job Costs = $20,000

This is the minimum amount you’d need to charge to:

1. Cover all direct job costs

2. Recover overheads/operating expenses

3. Reach your target pre-tax profit margin

You may wish to add an extra 1-2% to account for unexpected costs or inefficiencies.

Also remember, that every 1-2% that you take off your job price (if you succumb to discounting) comes directly off your net profit margin!

If you would like closer guidance on how to ensure you are pricing for profit every time, connect with the team at PROTRADE United.

Work out the total costs for delivering the job. Include:

All materials

• Sub-contractors (what they will invoice you for)

• Specialised equipment hire (if you own your own – still charge the customer what you would have to pay in hire fees if you didn’t own it. EG: Jetter, digger, etc.)

• Waste/rubbish removal

• Job specific council/compliance/insurance fees & charges

• Field labour that you employ directly***(from start to finish of the job)

*** With your field labour that you employ directly, use the Hourly Rate Calculator on the PROTRADE United Website to determine the actual cost per hour for each employee. The calculator will account for salary (plus extras), available days per year (after entitlements), inefficiencies/hold ups such as weather, training, meetings, errors, etc.

For example: Total Direct Job Costs = $20,000

This is the minimum amount you’d need to charge to:

1. Cover all direct job costs

2. Recover overheads/operating expenses

3. Reach your target pre-tax profit margin

You may wish to add an extra 1-2% to account for unexpected costs or inefficiencies.

Also remember, that every 1-2% that you take off your job price (if you succumb to discounting) comes directly off your net profit margin!

If you would like closer guidance on how to ensure you are pricing for profit every time, connect with the team at PROTRADE United.

Use a powerful diagnostic business tool, to understand the current reality

Uncover the obstacles that may be holding you back from more profits, time and freedom

Craft a realistic action plan to produce results in the next 6-12 months

Gain recommendations specifically designed for trades and construction businesses operating in Australia & New Zealand